U.S. Patriot Act

Searches / OFAC Compliance

What is OFAC?

OFAC is

an office within the U.S. Department of the Treasury that “administers and

enforces economic and trade sanctions based on US foreign policy and national

security goals.”1 While OFAC has been involved in sanctions programs

since the War of 1812, Congress’s passing of the U.S. Patriot Act in the

aftermath of the events of 9/11 has led to an increase in OFAC’s operations to

curb terrorism. OFAC’s efforts include:

Sanctions Programs

There are three types of sanctions programs – comprehensive,

limited and targeted. According to the OFAC 2012 Financial Symposium:

·

Comprehensive programs are those such as with

Cuba, Iran, Sudan and Syria. With a comprehensive program, generally all

activities are prohibited.

·

Limited sanctions, such as those with Burma,

North Korea and involving conflict diamonds, allow certain activities. For

example, exporting may be allowed, but not importing or investing. Each country

or target may have different restrictions. Therefore, it is necessary to know

which restrictions apply, and when.

·

Targeted sanctions mean an activity is on the

sanctions list for a particular reason, such as narcotics trafficking or

Somalian piracy.2

Licensing

All sanctions programs have exceptions of some sort and these

exceptions may be handled through a license. An example may be General License

11, which allows for the transfer of services by non-governmental

organizations. Another license may allow for the export of food to sanctioned

nations (such as Iran or Sudan), although the countries themselves may be under

a comprehensive program.2

The Specially Designated Nationals and Blocked Persons List (SDN List)

OFAC maintains a listing of

restricted parties called the Specially Designated Nationals and Blocked

Persons List (SDN List). Names are added to and removed from this list

continually.2 Failure to understand and properly comply with the

Office of Foreign Assets Control’s (OFAC’s) requirements in this area can lead

to results as mild as a cautionary letter or as severe as civil or criminal

penalties.

Who needs to be OFAC compliant?

If your company deals in the transfer of funds, you must

practice due diligence when dealing with clients in order to comply with OFAC

requirements. This also applies if your company assists with the formation of

corporate entities. This means that you or your service company needs to

understand the OFAC Sanctions Programs (comprehensive, limited and targeted)

and be aware of the SDN List.

What can you do to be OFAC compliant?

We have found that people/entities who neglect their

responsibilities are usually penalized more harshly than those who have written

internal processes but who somehow have a target slip through their process.

Once a violation is recognized, information is gathered and

the violator should be prepared to answer such questions as why the target was

missed and what happened. In determining an action to be taken against the

violator, such items as whether it was a willful or reckless violation, the

violator was aware of the conduct when approving the transaction, a compliance

program was in place or not, cooperation with OFAC occurred during the investigation,

etc. are taken into account. Actions can include a no action letter, a

cautionary letter, a finding of a violation (civil or criminal penalties may be

assessed) or a settlement.2

OFAC’S current focus is wire transfers. All wire transfers

need to be screened. According to the OFAC 2012 Financial Symposium:

Particular risk occurs if the

recipient of the transfer has overseas branches or subsidiaries, if the

transfer came from a high-risk bank, the type of product offered for sale, how

much internal quality control is in place and if the recipient has had a high

number of OFAC incidents in the past. Ways to mitigate risk include keeping and

using an updated SDN List, reporting incidents of missed identification,

significant recordkeeping, and due diligence, including having tailored,

written policies and procedures in place.2

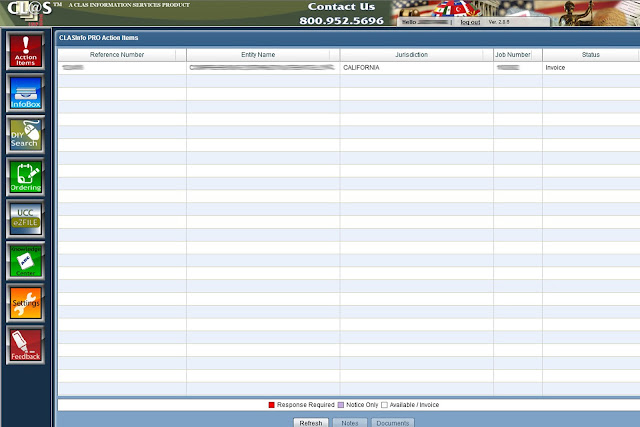

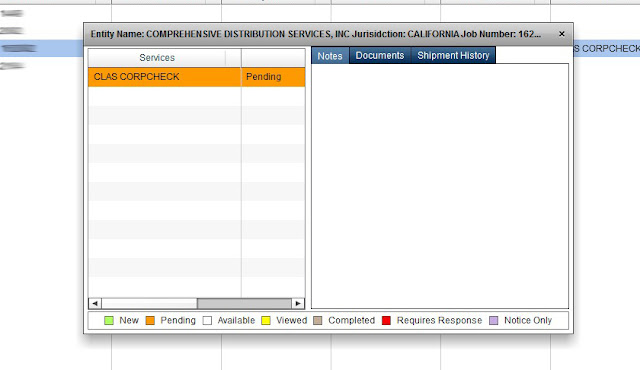

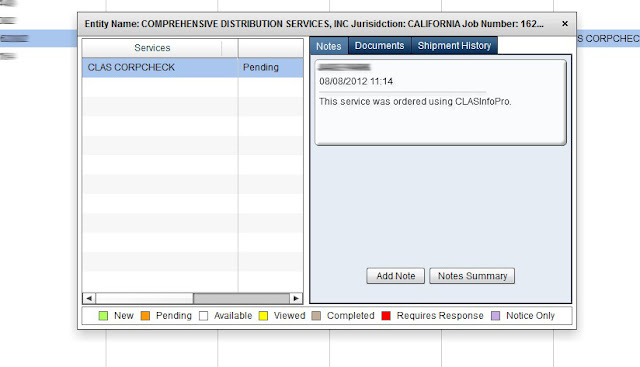

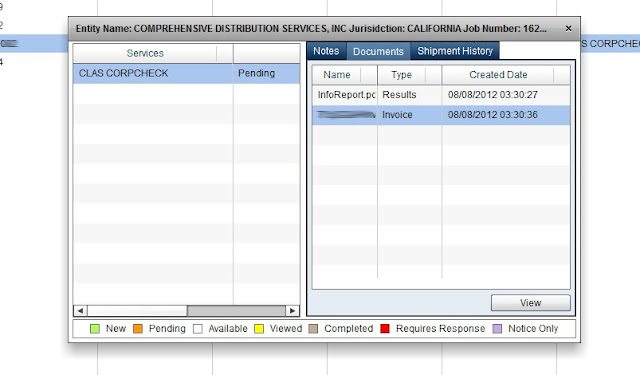

CLAS has processes you can utilize to track your compliance attempts. Contact a CLAS Service Representative by emailing Christy@clasinfo.com,

or by calling 800.952.5696. CLAS Information Services can be found online at www.clasinfo.com.

Sources: